I have lived in San Francisco, the petri dish for disruptive innovation in the US, for 20 years. I’ve witnessed the rise of Google, the revival of Apple, the inevitable spread and unnecessary fall of Uber, the unlikely success of Airbnb, and the metastasization of Facebook and its twisted business model. I also read the news, all of it, and have for the last 18 years. Every day.

I heard about Bitcoin in 2010, and even had some kids stay in my Pac Heights apartment, using AirBnb, while making a documentary about Bitcoin, in 2012. At that time I was occupied with other things, and the barriers to buying were too high, the shadiness factor too prominent, so I ignored it. For every AirBnB there are 500 other startups promising to change the world, paying for me to use their product or service for free. Bitcoin was just another crazy idea, born drowning.

I caught the hype cycle in 2016-2017. I patted myself on the back, got out, and forgot about it. I used Coinbase, obviously, because I was too busy with my life to bother with more friction. Investing in private equity is tough and requires capital to start with. I was focused on the old-fashioned methods of attaining that. Work.

Then 2019-2020 happened. All of a sudden the volume turned up 10x in the chattering tech startup community. I missed the rise, now, when I had the potential for exit-level appreciation. I always like to be careful, even in risk-taking. I was playing a game of attrition, while learning how to play the stock market.

I watched as friends got rich. I am not jealous. I just observe. I have made the decision to start my own company recently, and feel inspired about it. I still have no idea what that will be… but the discovery is fascinating. I read broadly. I practice. I exercise patience, diligence and deep thought. I decided to finally go to the source on this bitcoin thing.

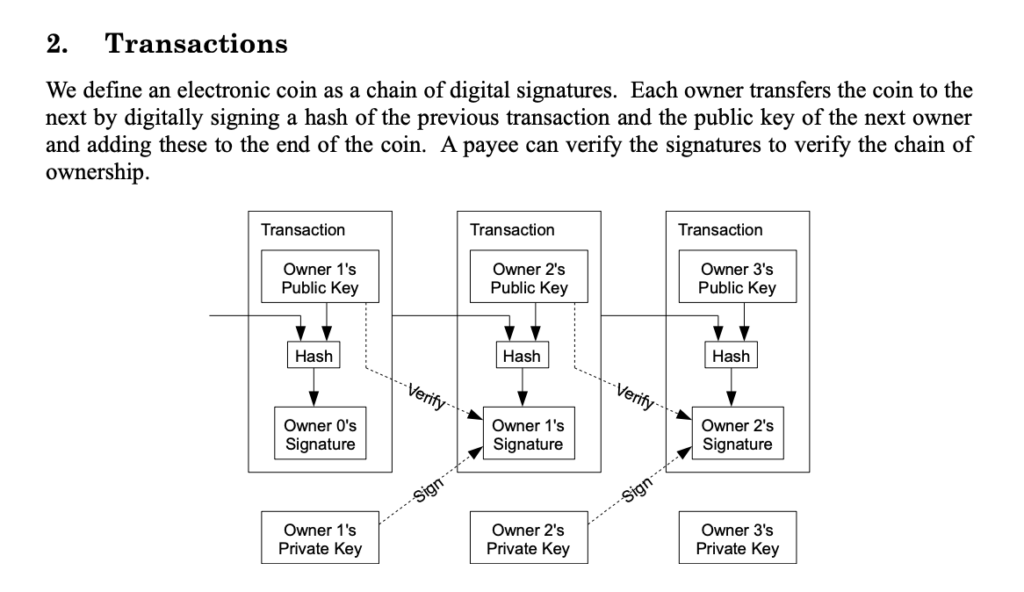

That meant I read the Satoshi Nakamoto white paper that started it all. I connected the dots to the last financial crisis. And my mind exploded.

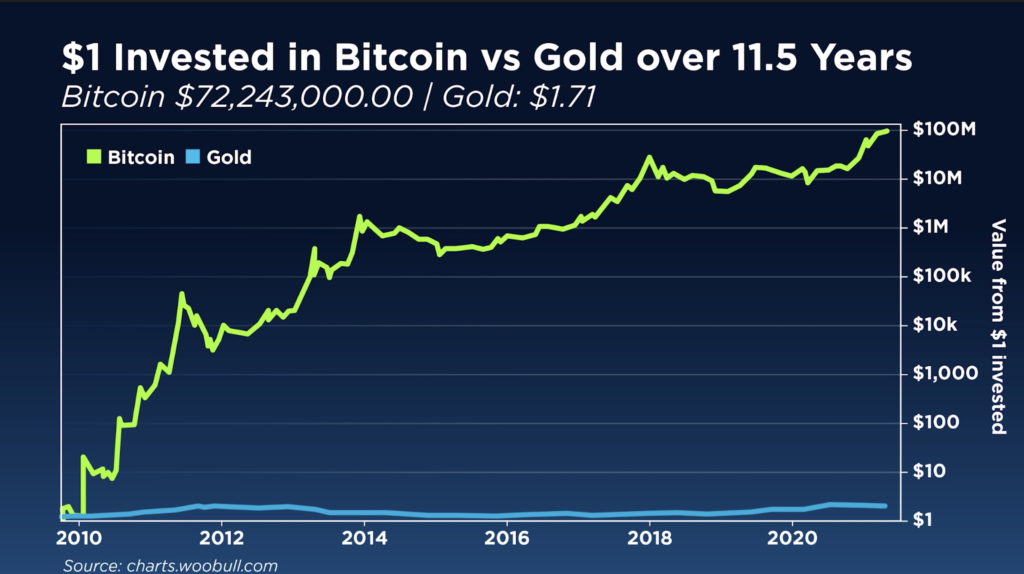

I now believe that Bitcoin is here to stay, and it is a hyper-growth disruptive technology, just like the other giants whose shadow has been my home. Whose rise and rise has shaped me. Except Bitcoin is a different thing. It is disrupting not just dollars, but cash currencies all over the world. And its unstoppable. In whatever future awaits us, as long as the lights are still on, Bitcoin will be a dominant store of value. Like Gold. But so much better.

Bitcoin is the best performing asset in history

Bitcoin is a trojan horse for freedom

Because of the blockchain, there is no authority that controls the value of Bitcoin. It is pure liquid supply and demand. And the supply is limited. To our current knowledge, this will never change, even with speculative computational capability.

The lack of control is one side of a coin that also contains the distributed nature of Bitcoin. It is truly peer-to-peer, and therefore can not be stopped by anything less than the alignment of the majority of the power on the globe. Even then, there are such incentives to allow it to continue, and disincentives to trying to stop it, that it seems unfathomable that any serious attempt would be made, let alone successful. The longer time goes on, the more this becomes true. IT is truly anti-fragile.

The technology behind Bitcoin, the Blockchain, has so many applications beyond finance, it may truly be able to fix the broken trust and social contracts that have been destroyed by social media, fragmented society, and social divisions, especially in the US. It may be true, actually, that I am more of a blockchain enthusiast than I am pure Bitcoin. But the one and the other are connected, as Bitcoin is the fist Blockchain to have been built.

Bitcoin is like a peaceful Manhattan project

The technological breakthroughs represented in Satoshi’s simple 9-page thesis paper are transformational. They have shaped the last 10 years and will continue to shape more and more the next decades and longer to come. Surely Satoshi, whether a person or a group, wherever they are, have become wealthy from their invention. Surely this is the way of time immemorial and cannot be held against them. And so too have many others. But the path Bitcoin took to the mainstream ran through drugs, and worse, notoriously. As well as making dreams come true. It is not a weapon, but liberation. Women in third world countries can accept bitcoin without needing a bank account. This allows them to own property and value and therefore assert independence from abuse, or control, but family or husband.

The true nature of Bitcoin is not speculative. The price will stabilize. The liquidity and usability issues will have networked solutions. And any government that does not start keeping reserves will be left in the dust. It will supplant the US Dollar as the global benchmark, both because of what it is, and because of the Dollar and Geopolitics of the US world order.

“I don’t trust crypto”

I hear this when I say these things, from skeptics. I used to say it too. I have seen too much vaporware and PR spin on the bootstrapped backs of hacked attacks on fortified industries. But I no longer feel that way. It is to be trusted, or not. It simply is, and what it is is eating the cash world. There is still more to disrupt, and the same financial bobbleheads telling you to sell are also saying in the following paragraph that they think it will ‘eventually’ go to 400k, or 600. Or 1 million. Nobody knows. But they are buying when you sell. And that is just the business plan form financial sharks. Don’t listen to them.

“they won’t let it take over’

This too is common thinking. They have tried. China banned it, but is also expending massive amounts of energy to mine more of it than any other country. They started their own cryptocurrency, but nobody is fooled, it is a tool for surveillance. Bitcoin is peer to peer and designed to be the opposite of that, which is why it is so helpful

India banned it. But that just made the citizens of India want it more, and it does not distinguish between ‘legal’ and ‘illegal’ since it is trustless and distributed. Reference it’s history.

Some can go missing, sure. But not like Gold. 80% of the worlds gold has been stolen by governments in the last 100 years. More is mined every day.

Instead, change your thinking. Bitcoin is here to stay. At some point we won’t be asking ‘How many dollars is my bitcoin worth’ but rather ‘How many Bitcoin does that cost’ and once that happens, government backed securities, and fiat currency, will no longer drive the financial world. Crypto will. Ruled by Bitcoin. And buttressed by Blockchain technology. Which might potentially solve some of the world’s biggest problems, including the human ones…

I am not a Bitcoin Maximalist

There will always be a need for other forms of exchange. And Governments will play a role, as will corporations and capital markets, just as they have during the capitalist world. Corporate feudalism often has no other check and balance than a properly governed cooperative national and international organization of concerned citizens, and power brokers.

I am not a financial advisor. This is just a personal blog. But if you are interested, here are some resources for further study:

Debate between Michael Saylor and Frank Giustra about Bitcoin vs. Gold

Federal Reserve: Defi will be Paradigm Shift

Warren Buffet on Inflation in the US (current May 2021)